Stay in the Know

News & Articles

The Construction Industry Scheme

Struggling with tax season? Our UK SME tax guide covers Corporation Tax, VAT, PAYE, and deductions—helping you stay compliant and save money.

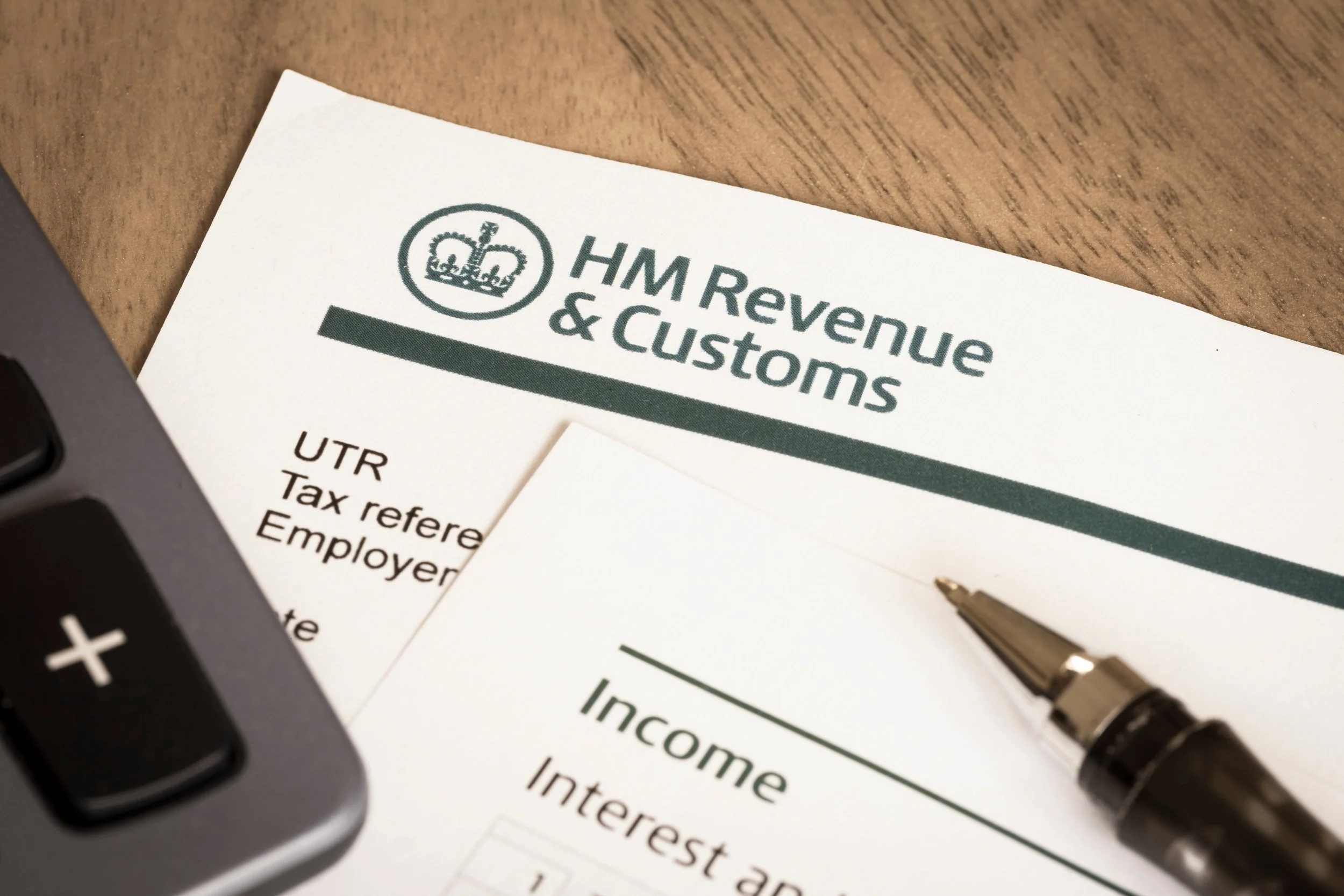

Self-Assessment Tax Returns for 2025: Expert Guidance from ABMV

Filing your 2025 self-assessment tax return doesn’t have to be stressful. At ABMV, we provide expert self-assessment tax return services to ensure your return is accurate, compliant, and submitted on time.

The Difference Between a Bookkeeper and an Accountant

Struggling with tax season? Our UK SME tax guide covers Corporation Tax, VAT, PAYE, and deductions—helping you stay compliant and save money.

Prepare for the Tax Season: A Guide for UK SMEs

Struggling with tax season? Our UK SME tax guide covers Corporation Tax, VAT, PAYE, and deductions—helping you stay compliant and save money.

4 Essential Tax Deductions Every Small Business Should Know

Discover key tax deductions every small business should know. Save on home office, travel, professional fees, and marketing expenses.

Payroll Outsourcing - Your Guide to Saving Money Today

Discover the cost-saving benefits of outsourcing payroll. Learn how it reduces direct costs, administrative burden, and compliance risks for your business.

January Bulletin 2025

As the year draws closer to its end, November presents a crucial time for businesses and individuals alike to prepare for the upcoming tax season and finalise their financial goals.

How to Choose an Accountant for Your Startup

Learn how to pick the best accountant for your startup with our guide. Find out what qualities to look for and the key questions to ask.

Digital Taxation: Adapting to Making Tax Digital for Income Tax in 2026

Prepare for MTD for Income Tax in 2026 with key deadlines, steps for implementation, and essential tools for a smooth transition.

Green Tax Incentives: Maximising Benefits for Your Business in 2024

Learn how to avoid 2024's most common tax pitfalls with practical tips and advice to keep your business compliant and stress-free.

2024's Most Common Tax Pitfalls and How to Avoid Them

Learn how to avoid 2024's most common tax pitfalls with practical tips and advice to keep your business compliant and stress-free.

How AI and Automation Are Shaping the Future of the Accounting Industry

Discover how AI and automation are transforming accounting with advanced tools and benefits for accountants in 2024.

The Benefits of Gift Aid and How It Works

Discover the benefits of Gift Aid and learn how it works to boost your donations to charity without costing you extra.

November Bulletin 2024

As the year draws closer to its end, November presents a crucial time for businesses and individuals alike to prepare for the upcoming tax season and finalise their financial goals.

Benefits of Filing Your Tax Return Today

Discover the benefits of filing your tax return early, from avoiding penalties to better financial planning in 2024.

All I want for Christmas is a Staff Christmas party …

With the holiday season fast approaching, many employers are planning ways to reward their teams for a year of hard work.

Tax Obligations for Online Sellers

Learn about tax obligations for online sellers, including VAT, record-keeping, and international sales compliance.

Autumn Budget 2024

Please find a summary of the announcements from the Autumn Budget, where we highlight the key talking points.

UK Businesses and High Interest Rates: Essential Insights

Explore how high interest rates affect UK businesses, discover management strategies, and prepare for the future.

EIS and VCT Extension: Key Tax Incentive Opportunities for Investors

Explore the benefits of EIS and VCT extensions. Learn about tax incentives, investor eligibility, and tips to maximise your investment.